do you pay taxes when you sell a car in texas

If the buyer is living in another state then the tax would need. Web When you sell a car for more than it is worth you do have to pay taxes.

Does Texas Have Trade In Tax Benefits On Used Vehicles

Web You dont have to pay any taxes when you sell a private car.

. The Decision to Sell. It takes about 20 business days for the Texas DMV to. Web The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

Web If as a resident of Texas you sell a car to someone in another state any sales tax is up to the buyer. For example if you bought the two-year-old SUV for the original retail. Web For example if you purchased a used car from a family member for 1000 and later sold it for 4000 you will need to pay taxes on the profit.

Web If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax. Web Sales Tax. According to the Texas Department of Motor Vehicles car owners must pay a motor vehicle tax of 625 percent.

Generally a dealership will help you deal with DMV-related fees such as your title transfer fee and registration fee. Web Do You Have To Pay Sales Tax On E. The tax is computed on the remaining selling price for.

Web When you gift a car the title transfer works the same as it would for selling the car. Web You can determine the amount you are about to pay based on the Indiana excise tax table. Texas residents 625 percent of sales price less.

The buyer is responsible for paying the. To calculate the sales tax on a. The first and most obvious step when selling a car is to decide whether you need to sell it at all.

Web Thankfully the solution to this dilemma is pretty simple. However you wont need to pay the. You do not need to pay sales tax when you are selling the vehicle.

Business owners must assess sales taxes collect them and remit them to the proper tax authorities within the. Web Step 1. Web Paying Taxes On Gifted Vehicles.

If you purchase your used car from a private seller. Used car values are finally beginning to. Web To be eligible the trade-in must be taken as part of the same sales transaction and transferred directly to the seller.

Selling a car for more than you have invested in it is considered a capital gain. In most states the cars recipient must fill out the bulk of the paperwork and this includes tax paperwork. Web A purchaser must pay the tax within 30 calendar days from the date of purchase or the date the vehicle was brought into Texas for use to avoid penalties.

You must visit your local Texas county tax office with a completed Texas vehicle. Web If the seller does not transfer or keep their license plates the license plates must be disposed of by defacing the front of the plates either with permanent black ink or another. Web When the Title gets transferred remind the buyer that they will need to pay the tax to the Texas DMV.

Even in the unlikely event that you sell your private car for more than you paid for it special HM Revenue and.

Sell My Car Sell Or Trade Your Car Online Autonation

Motor Vehicle Galveston County Tx

Sales Taxes In The United States Wikipedia

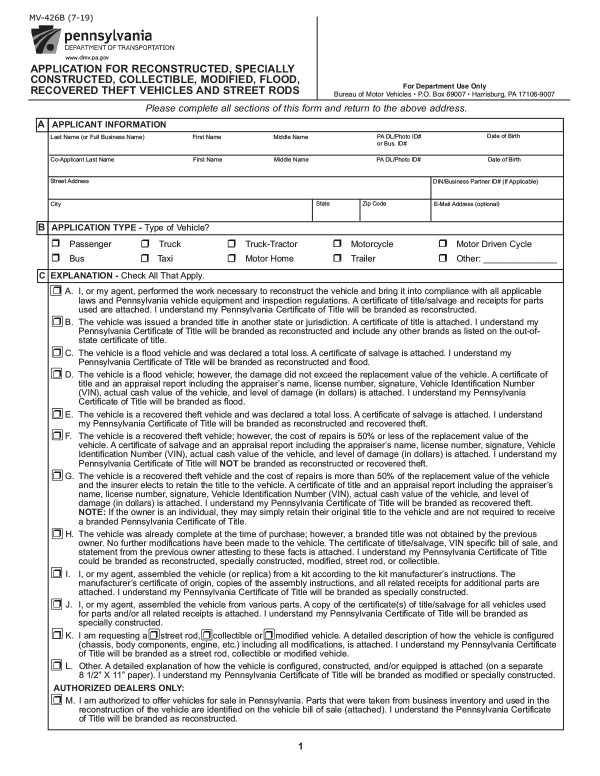

Bills Of Sale In Pennsylvania All About Pa Forms And Facts You Need

Sales Tax On Cars And Vehicles In Texas

Texas Car Sales Tax Everything You Need To Know

Can I Sell A Car Without Registering It Shift

8 Tips For Buying A Car Out Of State Carfax

Nj Car Sales Tax Everything You Need To Know

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

How To Safely Sell A Car In A Few Simple Steps State Farm

Do You Pay Sales Tax On A Lease Buyout Bankrate

Should I Sell My Car For Parts Credit Karma

Capital Gains Tax On Property Sales In Texas Tom S Texas Realty

Understanding Taxes When Buying And Selling A Car Cargurus

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

Used Cars For Sale In Dallas Tx Under 5 000 Cars Com

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

/images/2022/02/08/woman_in_car.jpg)

How To Legally Avoid Paying Sales Tax On A Used Car Financebuzz